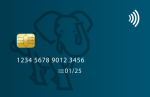

Creskard

Creskard is an International Prepaid Card in dollars, physical, that can be used anywhere in the world, at points of sale, for online purchases, and to withdraw cash at ATMs.

Choose the one that best suits you:

- Creskard Blue (with passport)

- Creskard Classic (with your National ID)

- Creskard Platinum (with your National ID)

Easily recharge from your Creska Virtual Account and manage your expenses.